From financial records to customer details, safeguard your PCI and PII from cyberthreats, prevent financial fraud, ensure compliance, and maintain customer trust.

Schedule a demo Download our data sheet

Integrating core banking systems, FinTech, and payment networks for seamless transactions amplifies the risk of cascading failures during cyberattacks.

The rapid adoption of digital identities, cashless transactions, mobile payments, and digital currencies creates more avenues for data misuse and exploitation.

Untrained or malicious employees with access to sensitive financial data can compromise data security.

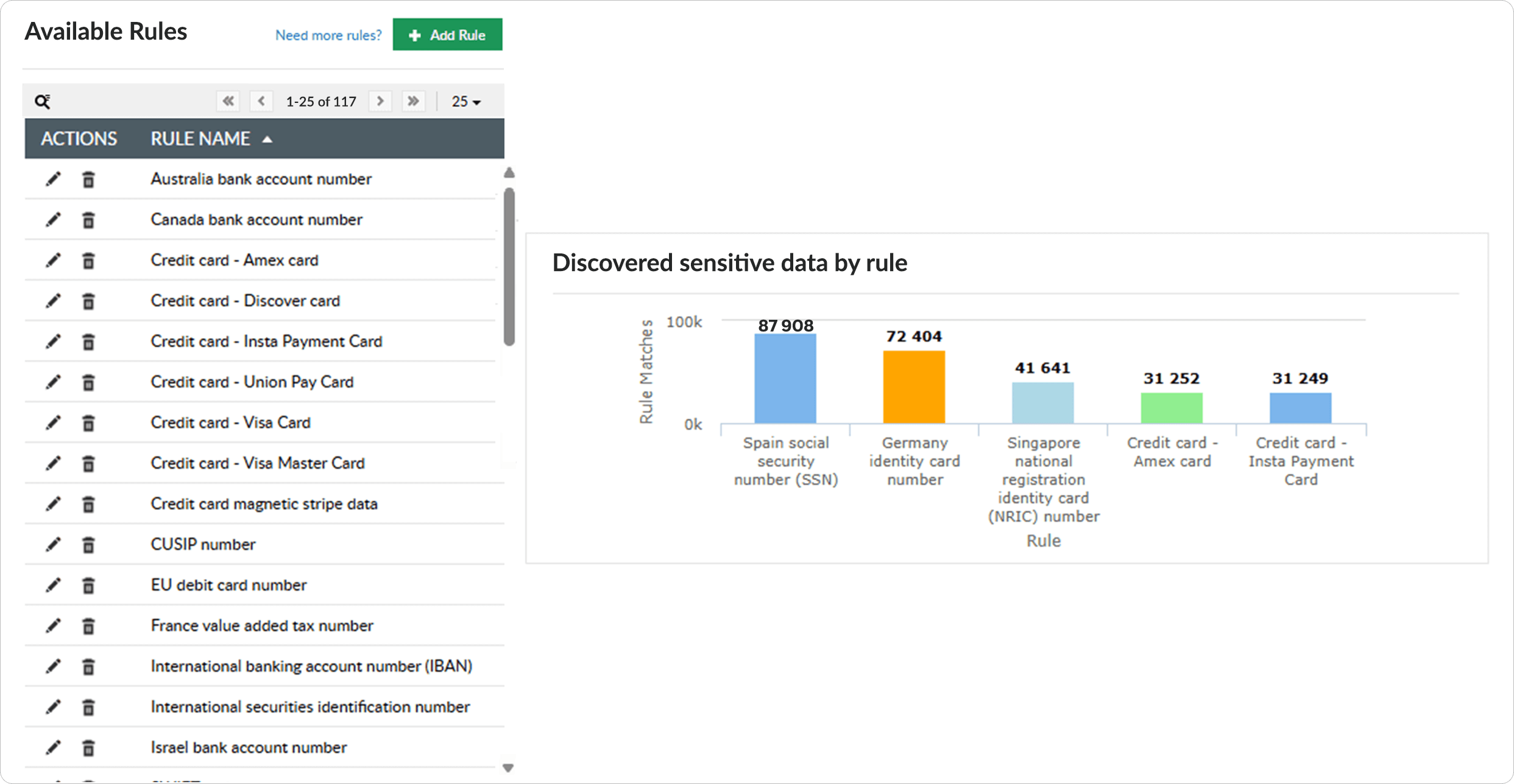

Use regular expressions, keyword matching, and over 100 predefined rules to discover and classify files that contain sensitive data, including account numbers, credit card details, and other transactional information.

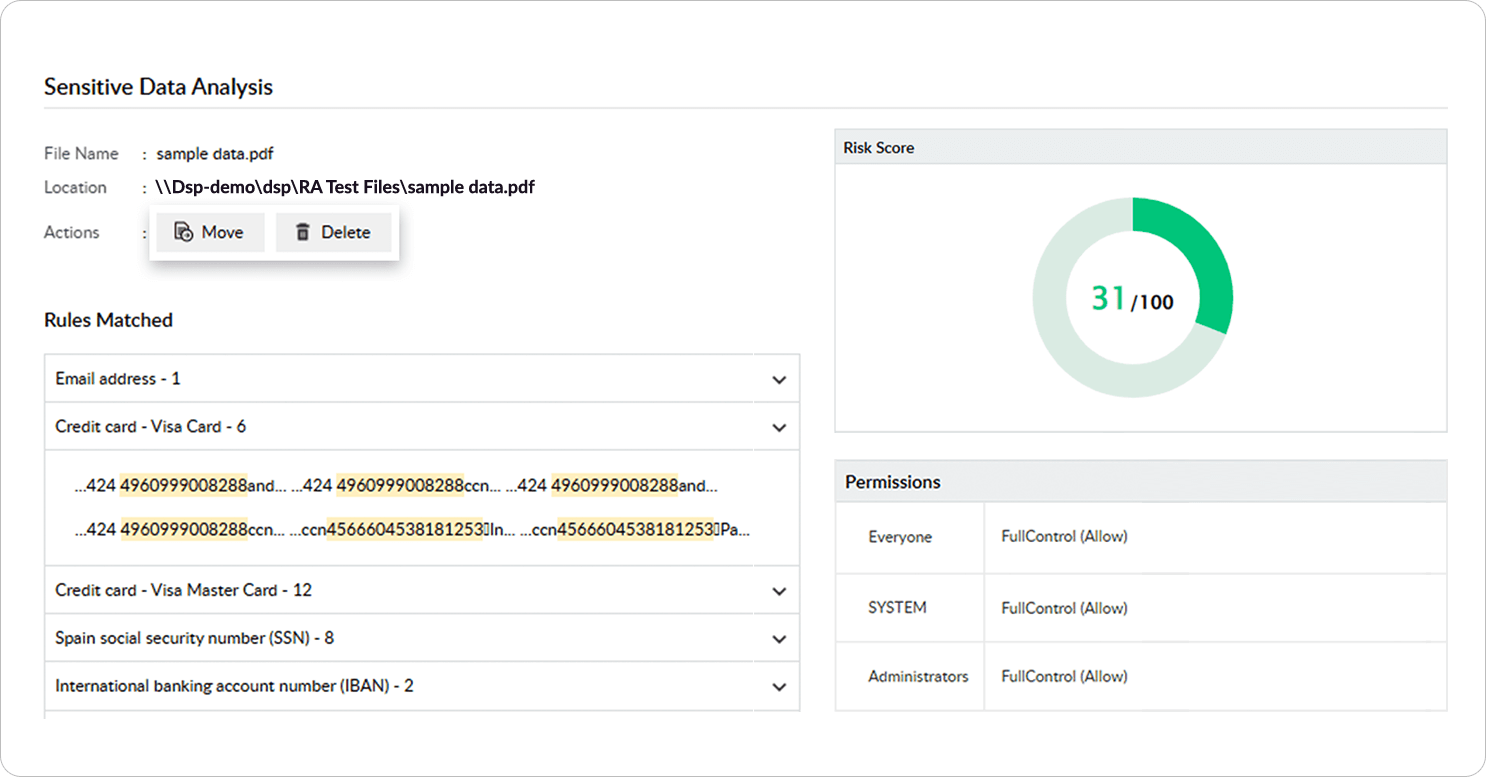

If files with card holder data or other financial records are unneeded, securely delete or relocate them. If they are deemed necessary, check if they have excessive permissions and apply proper security measures.

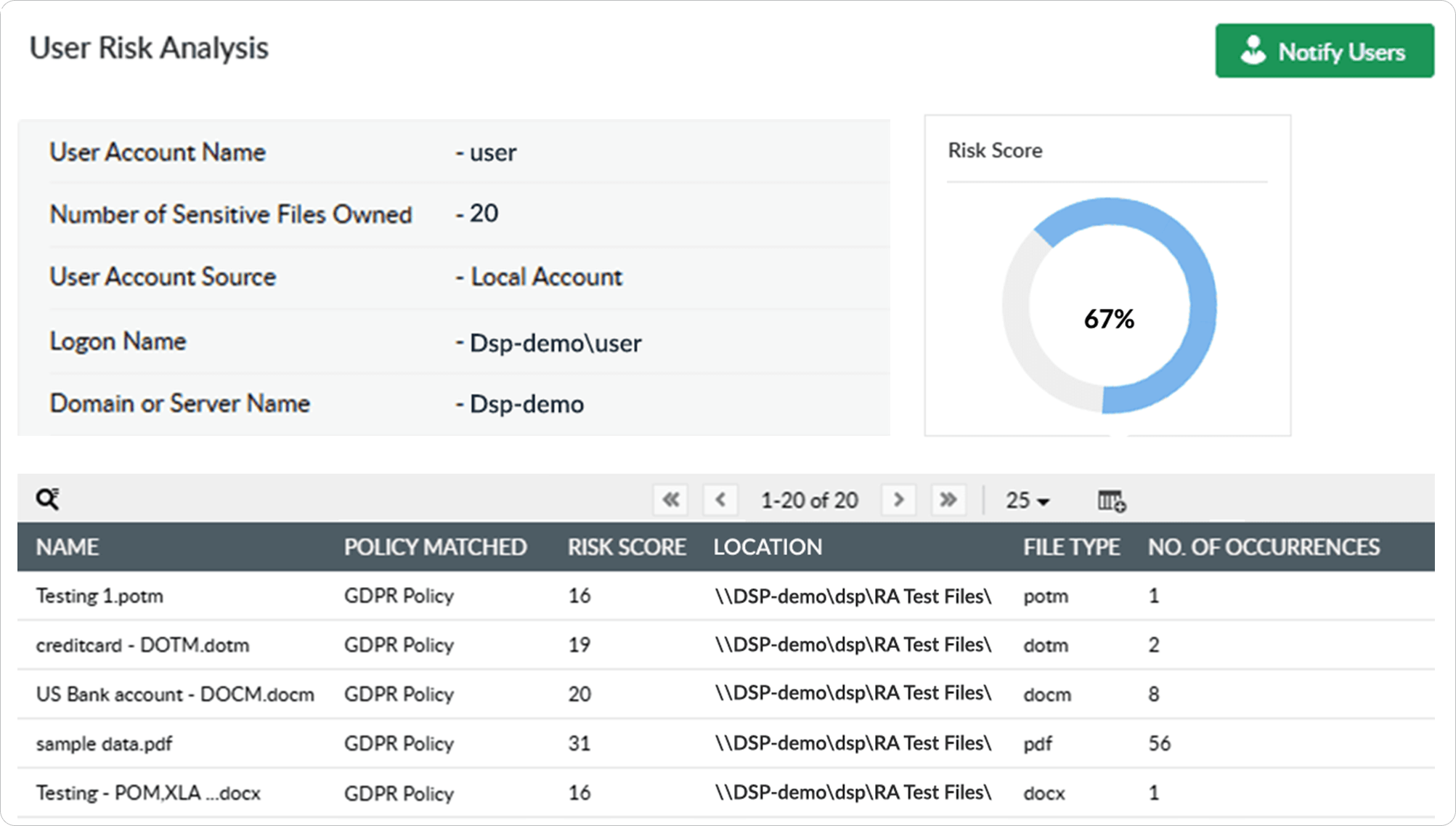

Identify users that own or have access to a large volume of financial data. Monitor their activity to ensure they are properly exercising their privileges.

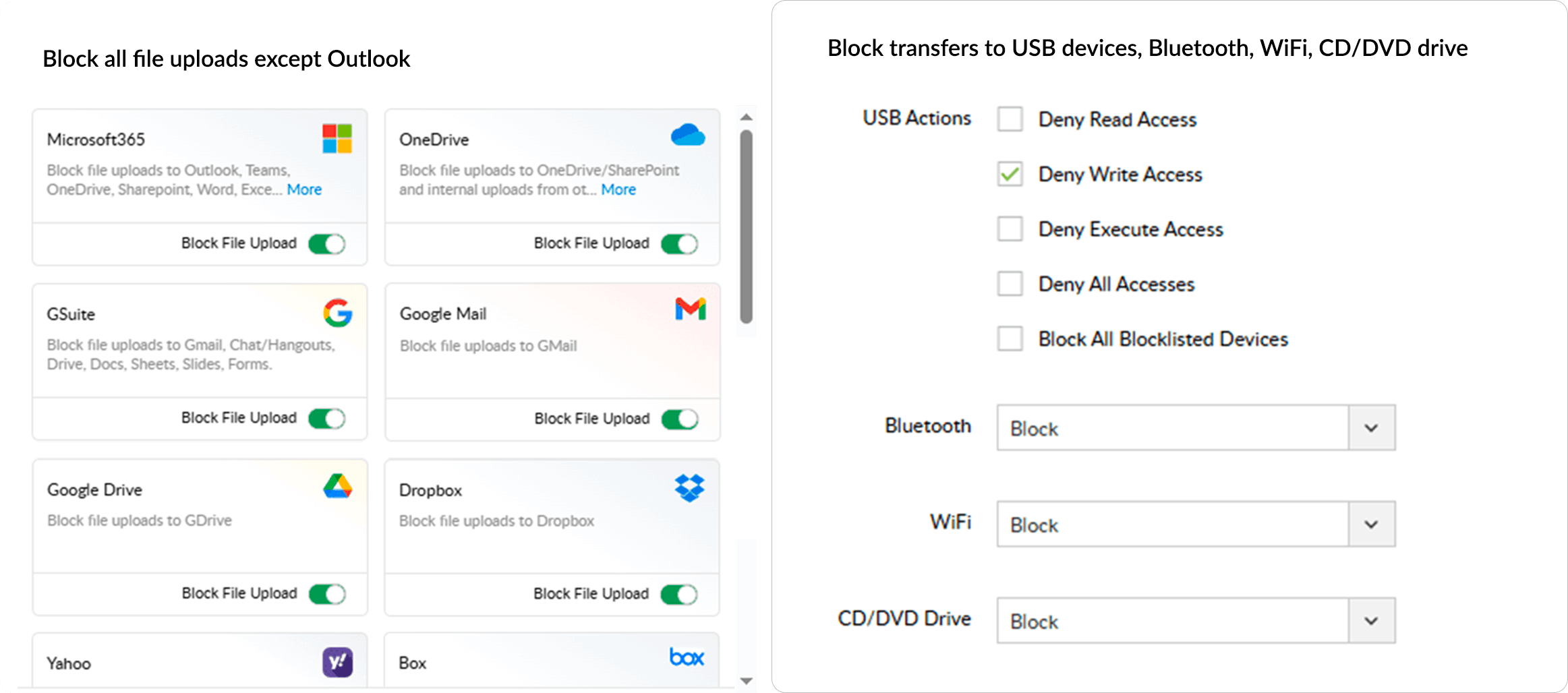

Prevent the leakage and theft of critical financial data by controlling data transfers via removable devices, email, cloud services, and more.

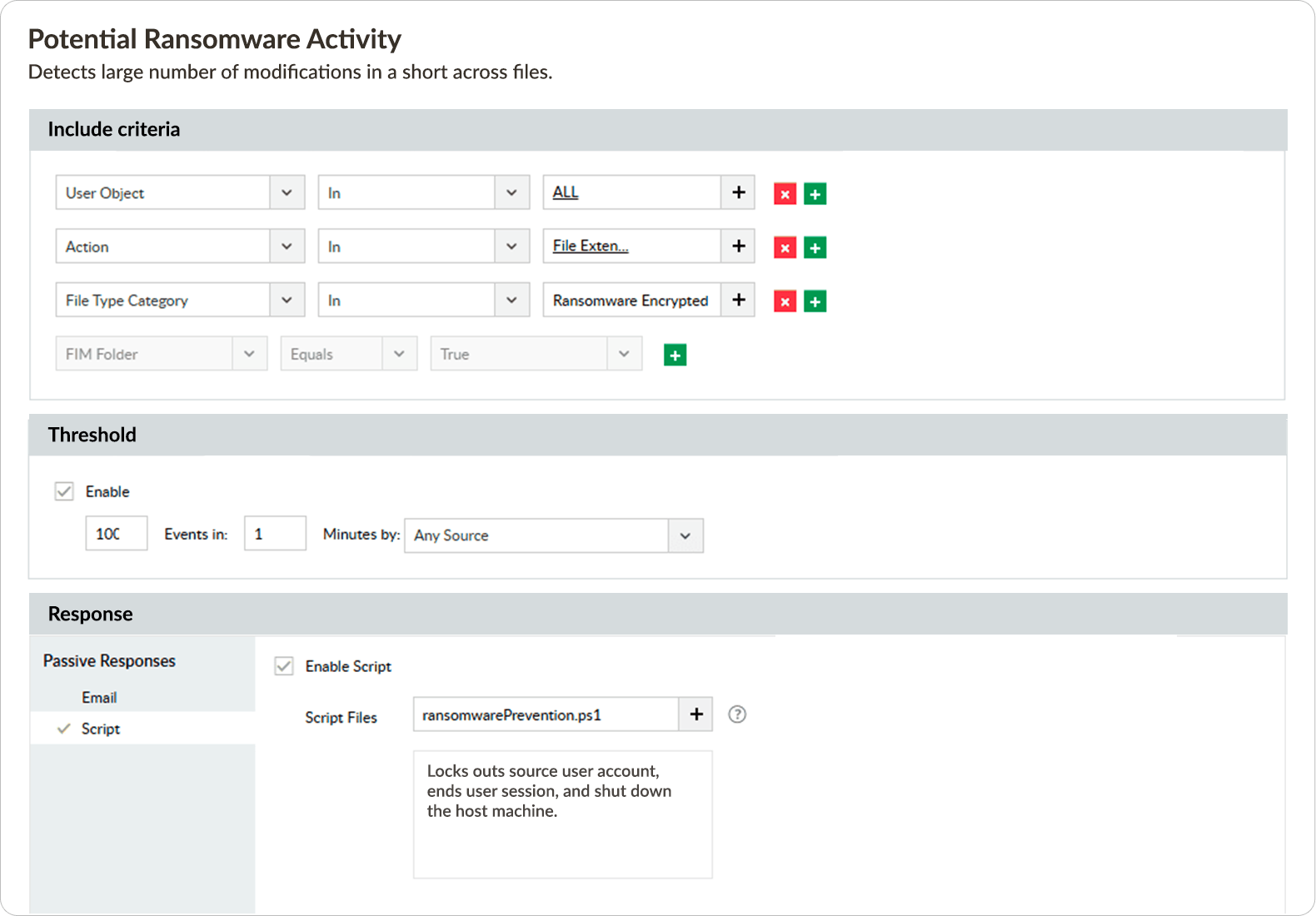

Get real-time alerts about possible ransomware attacks, malware intrusions, and data exfiltration and execute response scripts to stop them in their tracks.

Discover how your organization can use DataSecurity Plus to stay compliant with the following:

To learn how you can comply with other data security standards, visit the DataSecurity Plus compliance page.