The adoption of cloud computing in the financial services industry is accelerating due to benefits including scalability, flexibility, cost efficiency, and greater ability to innovate. The cloud enables financial services organizations to cater to huge volumes of user activity while providing round-the-clock operations. According to Gartner's 2022 Financial Services Technology Survey , 48% of banks have moved workloads to the cloud in some form or another.

While there are many benefits to financial services organizations of moving to the cloud, there can be plenty of security challenges too.

Top reasons for cloud usage in financial services

The financial services industry has experienced a significant shift towards cloud adoption. This movement is driven by the need for scalability, cost-efficiency, and the ability to innovate quickly in a highly competitive market. Cloud computing offers numerous benefits that are particularly valuable to financial institutions.

According to Forrester's Infrastructure Cloud Survey 2022, the top reasons for public cloud usage are:

1) Lower total cost of ownership for servers and storage (capex savings) Adopting public cloud services reduces the need for significant upfront capital expenditures on hardware and infrastructure. This shift to an operational expense model allows businesses to pay only for the resources they use, resulting in cost savings and improved financial flexibility.

2) Business continuity and disaster recovery Public cloud providers offer robust disaster recovery solutions, ensuring minimal downtime and data loss during incidents. These services include automated backups, geographic redundancy, and rapid failover capabilities, enhancing overall business resilience.

3) Provides developers with fast, easy resources for test and development The public cloud enables developers to quickly provision and scale environments for testing and development without waiting for physical hardware. This accelerates the software development life cycle, fostering innovation, and reducing time to market for new applications.

4) Ability to scale globally to reach a global user base (either internal or external) Public cloud platforms offer scalable infrastructure that can be deployed globally, allowing financial services enterprises to efficiently serve users across different regions. This capability supports international expansion and improves performance and user experience by reducing latency.

5) Improved ability to meet compliance regulations Cloud providers invest heavily in compliance certifications and security measures, helping businesses meet regulatory requirements. Leveraging these services simplifies the process of adhering to industry standards and enhances data protection.

Table 1 below describes the cloud-based functions in a typical financial services firm, and the associated solutions across IaaS, PaaS, and SaaS environments. The representation is for reference and is not intended to be accurate under all scenarios. The objective is to provide a general overview of how cloud services can be leveraged in various aspects of financial operations.

| Function | IaaS | PaaS | SaaS |

|---|---|---|---|

| Virtual machines and servers | AWS EC2, Azure Virtual Machines, Google Compute Engine | ||

| Data storage and management | AWS S3, Azure Blob, Google Cloud storage | AWS RDS, Azure SQL Database, Google Cloud SQL | Google Big Query |

| Disaster recovery and business continuity | AWS Elastic Disaster Recovery, Azure Site Recovery, Google Cloud Disaster Recovery | ||

| Application development and deployment | AWS EC2, Azure Virtual Machines, Google Compute Engine | AWS Elastic Beanstalk, Azure App Service, Google App Engine, Kubernetes | |

| Data analytics | AWS Glue, Azure Synapse Analytics, Google Dataflow | AWS QuickSight, Google Data Studio | |

| CRM | Salesforce | Zoho CRM, Microsoft Dynamics 365, Salesforce | |

| Security auditing and compliance | AWS CloudTrial, Azure Security Center | ManageEngine Log360 Cloud, Splunk, Microsoft Sentinel | |

| Fraud detection | SAS Fraud Management, FICO Falcon |

Table 1: The various functions in cloud for financial services firms and the associated solutions in the IaaS, Paas, and Saas environments.

Cloud solutions for financial services offered by service providers

Some cloud service providers offer customized industry-specific cloud solutions for financial services to meet their unique compliance, security, and scalability requirements. Some examples include Microsoft Cloud for Financial Services and IBM Cloud for Financial Services. Google offers tailored solutions for banking, capital markets, insurance, and payments. By leveraging industry-specific cloud solutions for financial services, institutions can enhance their agility, flexibility, and overall competitiveness in an increasingly digital landscape. Many financial services firms feel that moving to the cloud has improved security and eased compliance and auditing, compared to an on-premises setup.

Cloud security considerations for the financial services industry

While the benefits of the cloud for financial services are clear, security remains a top concern for financial institutions. Protecting sensitive financial data is paramount, and there are several key security considerations to address when adopting cloud solutions.

The key considerations for cloud security in financial services can be broadly categorized as data protection, identity and access management, threat detection and response, and cloud vendor risk assessment.

Data protection : Financial institutions must ensure that they encrypt data both at rest and in transit. Even if data is intercepted, it cannot be read by unauthorized parties. Implementing strong encryption protocols and regularly updating them is crucial for maintaining cloud computing security.

Identity and access management (IAM ): Robust IAM solutions are essential to ensure that only authorized personnel have access to critical systems and data. Multi-factor authentication (MFA), role-based access controls, and regular access reviews help prevent unauthorized access and potential data breaches. For financial service firms using cloud for digital banking services, IAM can be vital.

Threat detection and response : Continuous monitoring and real-time threat detection are critical for detecting and addressing possible security issues. Financial institutions should implement advanced cloud network security systems that use ML and AI to detect anomalies and respond to incidents promptly.

Vendor risk management : When using third-party cloud service providers, it is essential to assess and manage the risks associated with these vendors. Financial services organizations must conduct due diligence, evaluate their security practices, and ensure they comply with relevant regulations and standards. This introduces the shared responsibility model (refer to Table 2) for financial services firms using the cloud. While cloud providers like AWS offer robust security measures for their infrastructure (IaaS), customers are responsible for securing their data and applications (SaaS and PaaS). This collaborative approach ensures secure cloud services and mitigates risks effectively.

| Which is more secure? On-premises or the cloud? The shared responsibility model makes cloud security a collaborative, often superior choice. |

||

|---|---|---|

| Responsibility | Managed by service providers | Managed by the customer |

| Infrastructure | Physical security of data centers | Data security and access controls |

| Platform | Security configuration of managed services such as storage and database | Secure configuration, coding, and patch management |

| Software | Security patches and updates | Access controls and data encryption |

| Operations | Availability of services and recovery | Monitoring, logging, and incident response |

Table 2: An overview of shared responsibility between cloud service providers and Cloud customers.

Compliance requirements for the financial services industry

Cloud compliance standards are a critical aspect when adopting the cloud for financial services. Financial institutions must adhere to a complex regulatory landscape to protect consumer data and maintain trust.

Financial institutions are subject to numerous regulations, such as the Payment Card Industry Data Security Standard (PCI DSS), the SOX, and the GDPR. These standards impose strict requirements on data protection, privacy, and financial reporting.

The top considerations when navigating cloud compliance for financial services industry include addressing data residency and sovereignty requirements, maintaining rigorous audit and compliance reporting practices, and leveraging automated tools to ensure continuous adherence to regulatory standards. Here are some of the major compliance requirements:

Data residency and sovereignty : Cloud compliance standards often require that data be stored and processed within specific geographic locations. Financial institutions must understand and comply with data residency requirements to avoid legal and regulatory issues. This involves selecting secure cloud services with data centers in the required jurisdictions, ensuring that the data remains under the legal sovereignty of the selected location.

Audit and compliance reporting : Regular audits and detailed record-keeping are essential to demonstrate compliance with regulatory standards. Financial institutions must maintain comprehensive logs of all cloud activities, including access logs, transaction records, and security incidents. These records should be readily available for regulatory inspections and audits.

Automated cloud security compliance tools : To ensure continuous compliance, financial institutions can leverage automated compliance tools. These tools help monitor and enforce compliance policies, generate compliance reports, and provide real-time alerts for any violations. Automation reduces the risk of human error and ensures that compliance processes are consistently followed.

Log360's solution to cloud security and compliance for the financial services industry

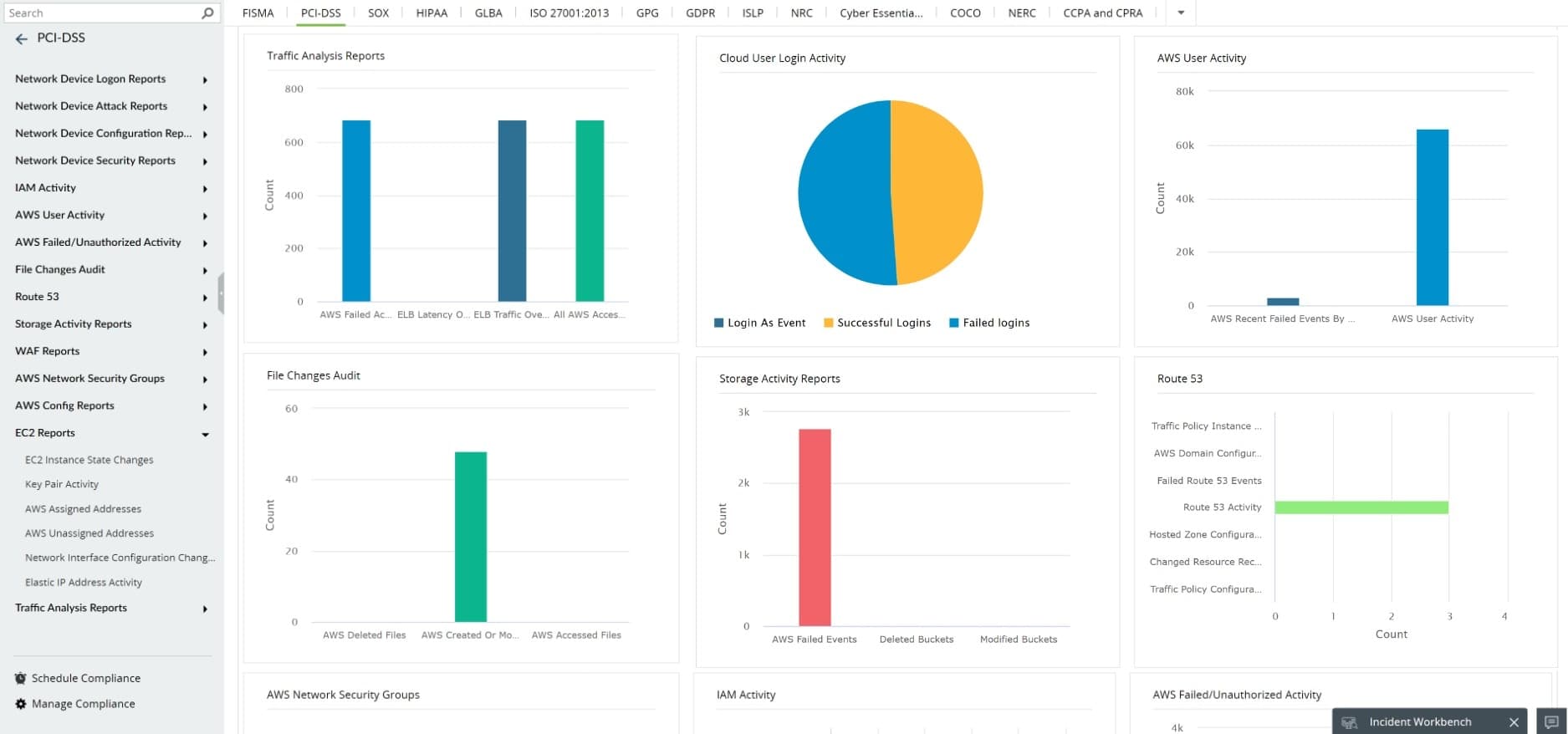

ManageEngine Log360 addresses the complicated security and compliance needs of the financial services industry. This is reflected in Log360's advanced log-monitoring capabilities, which allow for comprehensive security audits, compliance management threat detection, and response for both on-premises and cloud-based systems. This includes automatic compliance reporting for a wide range of regulatory demands of financial services firms, and security reporting for multi-device environments for data and threat protection.

Figure 1: PCI DSS compliance reporting in ManageEngine Log360.

Interested in seeing how Log360 can elevate cloud security and compliance in the financial services sector? Request a personalized demo from our experts today!